Twilight on the sky – dawn or dusk?As the year draws to a close, I sat down to reflect -How do I summarise the year gone by? Has it been a year of missed opportunities or has it been a year of challenges and cleansing the system that has put India on the threshold of exciting times ahead? As an optimist, I would like to believe the latter. There is no denying the fact that for me and for many Indians, there is a sense of disappointment as well as frustration. Disappointment sets in when efforts do not pay off. Although very feeble, there have been efforts to set things right. Frustration is born when we get stuck and, things do not move. To me it seems that this is more relevant in the Indian context at the present moment. We have to admit that India’s problems are self created. At a time when India should been a favoured destination both for FDI and portfolio investment, it is being shunned by global investors seeking growth. Will things get worse before they get better? Is this time to be fearful or be greedy? Before attempting to answer the question, I thought of listing the events or happenings during the year: Year end musingsWe started the year with great optimism and confidence: the BSE Sensex was looking set to scale an all time high. But things changed and, changed very rapidly. The past year had many market moving headlines

I would like to believe that the situation is bad but not irreversible. While some may interpret and conclude that 2011 was the year of missed opportunity, I am inclined to believe that India is on the threshold of years of strong growth. Notwithstanding the short term blips, the India story is far from over. Notes from my interaction with investorsIt is heartening to know that investors in QuestPMS (existing and prospective) share the optimism about the long term growth opportunities in India. This has enhanced my conviction, especially since many of the investors manage businesses and, are more closely connected to economic developments on a real time basis. But there are apprehensions. I have attempted to summarize the apprehensions:

I am sure there are negatives. We can all see them and, we are aware of them. But during my investment career, I have seen markets factor these a lot sooner than most people expect. And when this happens, markets recover and, often at great speed. I remember reading “Life can only be understood backwards, but it must be lived forward.” – Soren Kierkegaard. As I look back on my investing career of over two decades, I have realised that this is also true of investments. Do I start investing?There is no one answer. But I am reminded of what my yoga guru, Guruji Yogacharya B.K.S. Iyengar, once told me –“The beginning is always the hardest. Remember you’ll accomplish more if you start now”. Here are a few things that I told myself:

As an illustration let me point out the way in which infrastructure stocks (in power and capital goods segment) have been beaten down. It is true that there has been a slowdown in order inflow and, a falling rupee has offset any gains from lower commodity prices and, impacted margins. But I refuse to believe that there are no companies with a strong balance sheet that cannot handle these short term shocks and, come out shinning once the investment cycle reverses. The need to seek a strong balance sheet cannot be over-emphasized: as the half yearly results for FY12 show that debt can wipe out the profits of a company. At Quest, the team has steered clear of such debt laden companies. So does one go ahead and buy such companies today? Once again I must confess that there is no unique answer. Honestly, it has been my belief that it is better to focus on fundamental factors and, look at the intrinsic value of a company’s business instead of worrying about short term market movement.

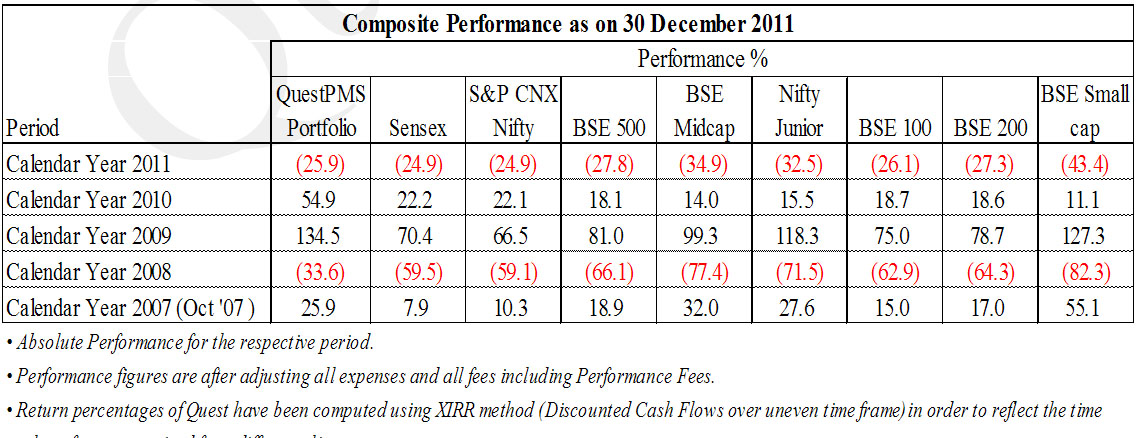

At Quest we share the view that it is important to assess value and, the longer you have been doing the same thing, the greater your learning and, more likely you become better at doing it. There is a caveat: You must recognize and learn from your mistakes. Those that do, come out stronger. This is especially true in investing. The performance of QuestPMS has disappointed all of us who believe in the long term India story. But the team is not disillusioned with the investment philosophy as it has seen that share prices eventually catch up with the fundamental strengths of the business -e.g. in CY2009 and CY2010. Is it dawn or dusk?It is my view that even in this cacophony of policy paralysis some companies will continue to perform, although at a lower level of their potential. I also believe that the government will move ahead with policy formulation, although I am unable to predict the timing. It is not possible for a human being to know about everything and, at all times. If this ever becomes true, especially knowledge about the future, then he would no longer be human. At Quest, the underlying theme through the course of next year will be to continue to focus on quality and earnings visibility more than anything else, especially at a time when the macro environment looks pretty clouded. In conclusion, I am optimistic that the twilight on the sky is the beginning of dawn. My best wishes to you and your family for the New Year. Warm regards, Ajay Sheth December 30, 2011 To know more about Quest and QuestPMS please visit our website: www.questinvest.com DISCLAIMER: This communication does not constitute or form part of any offer or recommendation or solicitation to subscribe or to deal with QuestPMS. The views expressed by Ajay Sheth, Portfolio Manager QuestPMS are his personal views as on the date mentioned. These should not be construed as investment advice to anyone. This communication may include statements that may constitute forward looking statements. The statements included herein may include statements of future expectations and are based on the author’s views, observations and assumptions and involve known and unknown risks and uncertainties that could cause the actual results, performance or events to differ substantially or materially from those expressed or implied in such statements. The author does not undertake to revise the forward looking statements from time to time. No representation, warranty, guarantee or undertaking, express or implied is or will be made. No reliance should be placed on the accuracy, completeness or fairness of the information, estimates, opinions contained in this communication. Before acting on any information contained herein, the readers should make their own assessment of the relevance, accuracy and adequacy of the information and seek appropriate professional advice and, shall be fully responsible for the decisions taken by them. |