Managing expectationsWhat a turnaround in investor sentiment over the last couple of months! From being bearish and underweight on India and almost getting ready to give India the go bye, foreign investors have returned with a vengeance. The concerns and negative sentiment that plagued Indian markets, especially from the middle of 2011, seem to have vanished. In the first two months of 2012, foreign institutional investors have invested almost US$6bn (over Rs.32,000 crores) in Indian equities. So does it call for celebrations? Not yet. As I mentioned in my last communication, liquidity has been the key driver for markets across the globe. In December 2011, there was an expectation that the European Central Bank (ECB) will inject between € 100-200 billion by way of Long Term Refinancing Option (LTRO). But the actual amount injected was almost € 500 billion. This exceeded the expectations and the markets rejoiced. I was reminded of a mathematical formula for happiness that I saw in the book “Numbered Account” by Christopher Reicht that I flipped through in a bookstore: When the expectation is very low, reality, even if it is marginally better that the most pessimistic, has a great impact on happiness. There is a flipside to this increase in happiness: it also brings along with it an increase in expectation. What can sustain the rally? Global markets: The € 530 billion injected by the ECB in the second round of LTRO announced on February 29 is likely to keep equities markets buoyant. With reports suggesting that the recovery in the US is not as strong as envisaged, expectations are building up that the Fed may announce QE3. The Bank of Japan that had refrained from a soft money policy even in the aftermath of the Lehman crisis in 2008, has now joined the ranks of Central Banks injecting liquidity into the economy. The policy decision seems to be influenced by the fact that many big names reported losses due to a strong yen, while competitors from other countries reported record profits. This step, to loosen purse strings, is being seen as a first step to adopt an inflation target. The implications are likely to be profound. Indian markets: In January 2012, India was coming out of very depressed sentiments. The surge in liquidity has meant that many of the stocks that were at the bottom of the heap during the gloom of December 2011, are now at the top of the returns table for the first two months of 2012. The sharp rally, driven largely by almost US$6bn (over Rs. 32,000 crores) of foreign inflows, has taken most money managers by surprise. The large dollar inflow has also stabilized the INR. The question on everyone’s mind is: how long will this liquidity driven rally sustain? Even though equity prices have risen sharply over the last couple of months, ample liquidity and expectations that more funds will be available has alleviated fears of losing money. Investors are more worried about missing out on an opportunity. Moreover, there is a very small cost attached to these funds. What can hurt the rally?

“When a government is dependent on bankers for money, they, and not the government, control the situation since the hand that gives is above the hand that takes money”. – Napoleon Bonaparte. Any default on the terms agreed upon by Greece in the bailout package may mean a loss of confidence amongst investors and, result in a full-blown European crisis that could reverse capital flows.

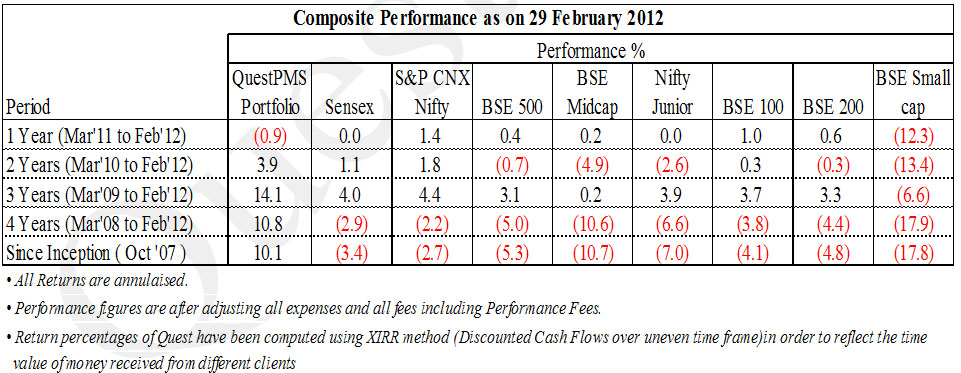

Performance of QuestPMS Like in any rally there are stories about how an investment in a specific (cats and dogs) stock has given 100% return in a few trading sessions. There is a sense of exuberance amongst investors in such stocks. There maybe a feeling of being “left out” or not “having participated” amongst investors who have not invested in these stocks. Long term investors, like us, recognize that investment in equities is not about easy money or once in a life time trade. Nor do we see our approach to equity investments swing to the pendulum of investor behavior, with risk on and risk off at the two extreme ends. At such times, momentum overrides fundamentals. This necessarily means that many times, we are not with the herd. The period of waiting for the stocks to realize their full intrinsic value is always the most difficult for long term value investors. I must confess that we have to learn to be lonely and, at times, there is feeling of discomfort. I have always asked my team to ignore these short term swings of the pendulum so that we remain focused on creating long term value for our investors. The table below gives the consolidated performance of QuestPMS and, reflects our commitment to generating absolute returns over the long term: On the one hand, I am delighted with a change in investor sentiment towards India, on the other hand, there is a worry: will we be able to live upto the expectations? Most long term investors now expect the government to put its fiscal house in order and, announce policy measures to help revive growth to 9% (from the 6.5-7% projected presently). This will ensure that the flow of money into Indian equities is converted to long term. When reality meets expectations The Indian equity market, at the current level, is unique in many ways: there are opportunities to invest in the large cap as well as mid cap stocks. The strong rally over the last two months has definitely raised a question in the minds of investors: Have the share prices raced ahead of fundamentals? Is there a risk of losing money by investing in equities at this stage? As always, my response is: there is no unique answer. But I do know for a fact that investing in equities based on a shift in sentiment that fluctuates between greed and fear, is dangerous. It is precisely for this reason my team and I remain committed to identifying those companies that are available at a discount to their intrinsic value. This means that the QuestPMS portfolio will continue to follow a bottom-up, stock specific approach. In the near term, we will maintain cash or cash equivalents that can be liquidated and deployed to invest in specific stocks that meet our investment criteria. A number of factors may come in the way of reality meeting expectations. Some are external and some internal. In the case of India markets, in my opinion, if we can address the internal factors adequately, the impact of external factors will be reduced greatly. India can then become a favoured investment destination for both top-down and bottom-up investors. Mr. Uday Kotak, Vice Chairman and Managing Director of Kotak Mahindra Bank in a recent interview aptly summarises the expectations to maximize the happiness equation: “The base effect works in India’s favour and there is an argument which is positive that if India can clock 7% plus sustainable growth and can manage its inflation below 6% and a fiscal deficit in this budget gets better control more through control over expenditure than just revenue measures. India can come back in a big way; investors are looking for clear signals and execution that India will run a tighter ship”. Warm regards, Ajay Sheth February 29, 2012 To know more about Quest and QuestPMS please visit our website: www.questinvest.com DISCLAIMER: This communication does not constitute or form part of any offer or recommendation or solicitation to subscribe or to deal with QuestPMS. The views expressed by Ajay Sheth, Portfolio Manager QuestPMS are his personal views as on the date mentioned. These should not be construed as investment advice to anyone. This communication may include statements that may constitute forward looking statements. The statements included herein may include statements of future expectations and are based on the author’s views, observations and assumptions and involve known and unknown risks and uncertainties that could cause the actual results, performance or events to differ substantially or materially from those expressed or implied in such statements. The author does not undertake to revise the forward looking statements from time to time. No representation, warranty, guarantee or undertaking, express or implied is or will be made. No reliance should be placed on the accuracy, completeness or fairness of the information, estimates, opinions contained in this communication. Before acting on any information contained herein, the readers should make their own assessment of the relevance, accuracy and adequacy of the information and seek appropriate professional advice and, shall be fully responsible for the decisions taken by them. |