Ignore blips: The Journey continues …..“Transformation is a process, and as it happens there are tons of ups and downs. It’s a journey of discovery – there are moments on mountaintops and moments in deep valleys of despair.” Rick Warren Since last two years, we at QuestPMS have been extremely bullish (see all our past quarterly newsletters at www.questinvest.com) and can humbly testify that we did prove right with the induction of NarendraModi government at the Centre. However, since beginning of 2015, we have modified our stance slightly with the theme: Celebrate the journey – Stop worrying about the potholes. And the theme continues even now. We firmly believe, India is on a threshold of a major growth phase with some blips (potholes). This is a journey of at least next 3 to 4 years if not more. But the overall trend is going to be one way: up. The question which investors are now asking is whether anything has changed on the ground because quarterly corporate earnings are not reflecting that. The guidance for the next quarter is equally bad. Most global equity markets are booming – a strange disconnect since most economies are struggling. So in the short term, with valuations at rich levels, trouble looms in the shape of possible interest rate increases by the US Fed. It is likely that our market will be range-bound with a negative bias. However, India’s medium to long term outlook remains very bullish. The story for India is going to play out over the next 3 to 5 years. The stage is set with lower crude oil prices, falling interest rates, lower fiscal and current account deficits, and higher GDP growth. Before we further go into it, let us look at the main theme of Railway Budget, The Economic Survey and the Union Budget 2015. Budget 2015: India can fly

But can India Fly in the Short-Run? While Modi government’s intent is noble, it will take at least few quarters before which it will be difficult for economy to show any meaningful revival.

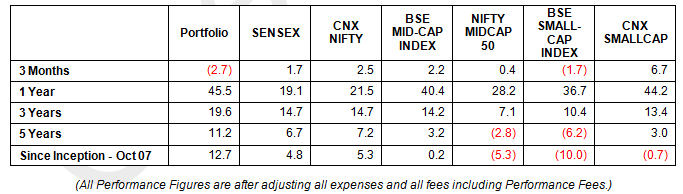

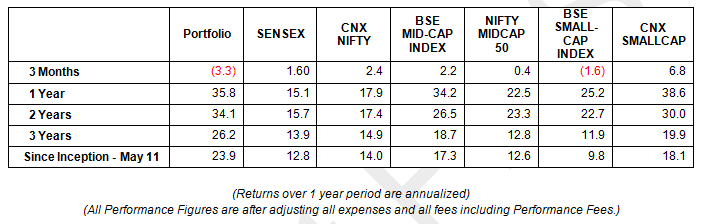

All-in-all, it is very clear that impact of many of the measures will be felt only over a period of time. So, while we may have relatively lower earnings growth for FY16, Budget lays a firm foundation for at least a four-year positive run for the economy and markets. The first major impact will be felt in FY17. If one has to use a cricket analogy, one would say the government is playing a test match i.e. their policies have a longer-term vision and implementation will take time; while investors are expecting results like in a T20 match. The moment one will see implementation on the ground, there will be a change in sentiment. What can go wrong? Post budget, the focus has shifted to its execution and implementations. Also, focus has shifted to approval of key policy legislation in Parliament – Amendment to Land Acquisition Act, Goods and Services Bill, etc.Uneasiness is creeping within the government in view of the attitude of its allies, particularly Shiv Sena and Akali Dal, openly opposing the clauses of Land Bill. It becomes difficult to cobble up a majority even in the joint session of Parliament. Most political parties including BJP allies feel threatened from Modi and so he might find it difficult to get cooperation from most of them at least in the short term till the party devices new strategy to bring them around. However, approval of three key bills (FDI in insurance, mineral mining and coal mines bill) by the Upper House also, marks a victory for the 10-month-old government. Thisevent will strengthen the reform agenda of the government. It is a strong boost to the confidence of investors, who have been looking for clarity and certainty in the policy regime. Further in a very positive sentiment booster, an independent, non-profit parliamentary research firm compared data of the current budget session with that of sessions for the last 10 years and concluded that less time was lost due to disruptions and more parliamentary and legislative business was conducted during this period. The possible spillover of volatility from global markets could be a spoiler in the short run. The few worrying developments globally are: increasingly desperate moves by the world’s central banks in terms of full-blown currency war, the divergence of economic performance globally, increased market volatility and losses, deflation in industrial and commodity prices and decreasing demand due to Peak Debt. Overall, India remains a wonderful market for global investors to diversify their portfolio given it has nothing to do with quantitative easing. The Indian economy is also in the process of bottoming out after a drawn out deleveraging cycle. If there is a risk for the Indian equity this year, it is that investors may become impatient waiting for evidence of a cyclical recovery. Still we are prepared to be patient since the stock market will be acutely sensitive to the operating leverage in Indian earnings on any hint of a cyclical pick up. QuestPMSPerformance : QuestPMS did not perform in line with various indices during the quarter Jan – March 2015. This was mainly due to froth created in some of the earlier quarters and some of our stocks gave away. Prices of stocks like Deepak Nitrite, KEC and KirloskarFerros declined from December 2014 level particularly in last one month. The composite performance table below givesour absolute performance vis-a-vissmallcap, midcap and largecap indices over different time periods Our performance for the quarter is downby 2.7 percent when compared to around1.7-2.5 percent rise in Sensex and Nifty. While this was largely because of price fall in few stocks like KEC, Deepak Nitrite and Kirloskar Ferrous which could be attributed to the following – partly due to profit booking, partly due to sharp depreciation in Euro currency vis-a-vis Indian Rupee which affected the export oriented companies performance (for the time being in the short run for one or two quarters) and also due to slowdown in infrastructure related companies. However, we expect this to be short term blip and this companies will start performing well as envisaged earlier. In absolute terms since inception, while all small and midcap indices have given negligible returns whereasQuestPMS has more than doubled our client’s initial investment after all expenses and fees. In fact, the performance at individual level is much better as overall PMS performance got negatively impacted due to untimely redemption (and booking of losses) during depressed period of2013 by quite a few of our clients. Looking at the strength of the current portfolio, we expect it to appreciate to a decent level from hereon in next 2 – 3 years. We expect the underperforming infrastructure sector to do extremely well in the ensuing 12 months. Currently, infrastructure, engineering and related companies comprises almost 40 percent of our portfolio. More than 65per cent of our AUM is made up of Kotak Bank clients. Their consolidated performance over last three and a half years has been stupendous. The composite performance table of all Kotak Bank clientsin XIRR based method is given below: We expect the average EPS for our portfolio companies to grow at around 30-33% over the coming couple of years and the forward (Mar-2016E) PE works out to around 12.04 times.We expect margin expansions in these companies on the back of incremental capacity utilization on the one hand and reduction in raw material prices on the other hand. Quest Foundation : We have started two new relationships in this quarter. First is with Sion Hospital (LokmanyaTilak Hospital) to give free medicine to needy Kidney Transplant patients. And second being with SNDT College – Wadala(were 6,500 girls are studying including almost 2,000 being Muslims) to pay fees of all needy students. For our new investors, we would like to repeat, it has been our stated policy to use Quest profits for various charitable activities that includes runningthe Quest Foundation, which is involved in carrying out spiritual activities like managing Iyengar Yoga classes and discourses on ‘Bhagwat Gita’ by Chinmaya Mission. Quest Foundation and Quest Foundersare also involved in various charitable activities including educational, medical and general aid to poor and needy. Final Thought : Let’s be fair and patient. Modigovernment has to be given time, as there are enough evidences to suggest that his government is moving in the right direction. Reforms take time to roll out and once out, they still take time to reflect on the economy, due to the lag effect. Also, India is a democratic country, where reforms function on consensus, rather than dictatorial whims. When the UPA government left, the economy was not in good shape. Also, the decision making machinery had broken down completely. With global volatility at its unprecedented high, it’s obvious that any new government would take time to correct things. Modi himself had gone on record that it would take the first two years to repair the economy and the next three years to induce aggressive growth in the economy. It is clear that he is settling down for a five year innings. What is evident is that sentiments have become more positive on the ground level. People are more optimistic with the Modi government. There is hope that this government would push reforms. Stock market is at an all-time high and FIIs are more bullish on India than ever before. So things are moving in the right direction, albeit not at the same pace one would have expected. The markets, in fact, have moved ahead of everything – be it earnings, economy. So what we will see now is probably markets consolidate until we start to see real growth in the economy picking up and translate into earnings growth for the market. While drastic fall in commodity prices will help improvement in profit margins in FY16, it is FY17 and beyond which will see not only substantially higher growth (lowering interest rate and reforms will help here) in the toplinebut also sharp increase in profit margin due to both fall in raw material prices on the one hand and improvement in economies of scale on the other hand. Also, if the inflation remains under control and we get a good monsoon, then we will definitely see more rate cuts. Fundamental based investing will get healthy returns over 3 to 4 years from hereon. We would like to end with our belief -Ignore blips: The Journey continues….. India is a bright spot on cloudy global horizon. Ajay Sheth March 31, 2015. DISCLAIMER: This communication does not constitute or form part of any offer or recommendation or solicitation to subscribe or to deal with QuestPMS. The views expressed by Ajay Sheth, Portfolio Manager QuestPMS are his personal views as on the date mentioned. These should not be construed as investment advice to anyone. This communication may include statements that may constitute forward looking statements. The statements included herein may include statements of future expectations and, are based on the author’s views, observations and assumptions and involve known and unknown risks and uncertainties that could cause the actual results, performance or events to differ substantially or materially from those expressed or implied in such statements. The author does not undertake to revise the forward looking statements from time to time. No representation, warranty, guarantee or undertaking, express or implied is or will be made. No reliance should be placed on the accuracy, completeness or fairness of the information, estimates, opinions contained in this communication. Before acting on any information contained herein, the readers should make their own assessment of the relevance, accuracy and adequacy of the information and seek appropriate professional advice and, shall be fully responsible for the decisions taken by them. |