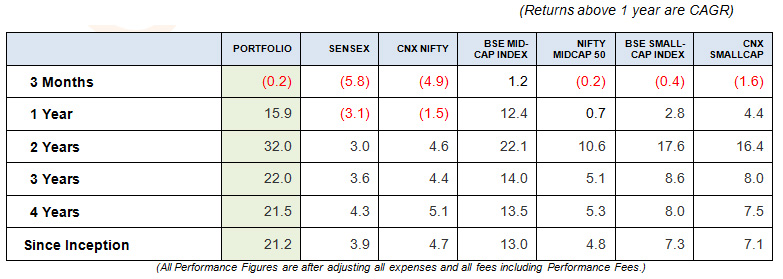

Opportunity in turbulent timesThe last two months have been “extremely choppy and sensitive” for the stock markets because of external factors. The markets have been extremely volatile with downward bias following Chinese currency devaluation and speculation over the U.S. Fed rate hike. Also, the excessive fall in oil and commodity prices are destabilizing economies and financial markets worldwide. While short-term certainly looks challenging, we believe, this global market flux won’t hit India’s real economy and this will remain a transient feature. India is on the cusp of a “potentially historic opportunity” because of China’s economic travails. Once the dust settles, India’s relative advantages would shine. India is a commodity importer and would benefit tremendously from softening prices. Once this indiscriminating phase of the market ends and the discrimination phase sets in, then actually India can distinguish itself as not just the very good emerging market, but possibly the best emerging market. Also, a powerful economic mechanism underlies the inverse correlation between oil prices and global growth. On all recent occasions when the price of oil was halved – 1982-83, 1985-86, 1992-93, 1997-98 and 2001-02 – faster global growth followed. Because the world burns 34 billion barrels of oil every year, a $10 fall in the prices of oil shifts $340 billion from oil producers to oil consumers. Thus, the $60 price decline over last one year will redistribute more than $2 trillion annually to oil consumers, providing the bigger income boost than the combined U.S. and Chinese fiscal stimulus in 2009. Also, an improving economic outlook in the U.S. has typically been followed by stronger growth, rising risk appetites and capital inflows in emerging economies. What is going for India…….. • Most emerging markets are in trouble. Growth in China is now nearly half the level it was at before the global financial crisis of 2008. Brazil and Russia are in recession.Turkey and Indonesia have done better than its peers. But India is perhaps the only major emerging market where growth will accelerate over the next few years. Global investors are right now wary of all emerging markets, but they will at some point differentiate between commodity exporters such as Brazil and commodity importer such as India. • India is tremendously benefiting on the back of sharp deceleration in oil and commodity prices. A stronger U.S. dollar and China’s cooling economy are adding to pressure on raw materials. Commodity prices have hit multi-year lows. This is pushing down inflation, slashing India’s import bills, boosting purchasing power and bolstering India Inc’s profit margins. • A sharp decline in global oil acts like a tax cut for the Indian economy in two ways. First, individual real incomes get a boost as local fuel prices fall. In other words, consumers have more money to spend on other stuff. Second, companies have lower input costs. The decline in commodity prices will lead to margin expansion for manufacturing companies. • Finally, a further decline in global oil prices has also created space for the RBI to increase the momentum of rate reductioncycle, with a 50bps rate cut yesterday. The larger point coming out of RBI monetary policy review is that the RBI and the government are on the same page to push growth. • If you look at last six-seven years, Sensex EBITDA margins have fallen from record high levels, from 22 per cent to around 16 per cent. When the EBITDA margins fall by six per cent, it will lead to very poor growth in earnings, and the reasons for those are very well known. But going forward, in our opinion, margins should start improving because commodity prices are down and that should have a good impact. • With China not doing well and its stock market in titters, Foreign Investors are losing faith in Chinese Administration. That may lead FIIs to divert more money to India once global dust settles down. Any serious global cracks may see central banks leap once more with quantitative easing. • The long-awaited shift of household savings from physical assets (gold and real estate) to financial assets (debt and equity) is finally happening. This is extremely positive for the markets, as domestic inflows into mutual funds would support equity prices (to some extent) at a time when foreign fund flows are reversing. The larger allocation of household savings to stock markets and other financial assets could also help fuel faster GDP growth even if FDI / FII flows slow down. • The ruling NDA with the help of issue based supporters, looks set to get the better of the main opposition bloc in terms of numbers in the Rajya Sabha by July 2016. This will bring the government within the striking distance of being able to push reform measures requiring parliamentary approval. Also, GST once implemented will not only add two percent points to our GDP but also can help in curbing domestic black money. What could work against India……… • We have Chinese economy, which is moving in a very divergent direction from the U.S. economy. Investors are speculating when U.S. might hike rate and when China might devalue the Yuan. There is a lurking risk of a large decline in capital flows to emerging economies in the upcoming U.S. monetary policy tightening cycle. • With U.S. monetary tightening, we might be entering the world of “quantitative tightening” representing an additional source of uncertainty in the global economy. Also, the world economy is no longer flush with liquidity the way it was in the aftermath of the 2008 financial crisis. The three drivers of this tightening are the collapse in oil and commodity prices, the economic slowdown in China and the QE exit by the U.S. • Back home, we have several negative dynamics, not least a crumbling real estate market alongside a feeble banking system and consistent difficulty on the government’s part to get reform moving in Parliament. • Deficient monsoon situation is certainly a major source of concern and may impact agricultural growth. • Slowing Chinese and Global economy, may affect India’s growth rates as its exports may suffer in coming period. • Spooked by China, FIIs sell $ 3.0bln of equities in August and $ 1.7bln of equities in September. In contrast, domestic institutions picked up equities worth $ 2.5bln in August and $ 1.6bln of equities in September. QuestPMS Performance: QuestPMS performed relatively very well during the quarter ended September 2015 despite sharp deceleration in global markets. This is not only due tothe quality of our stocks butalso due to reasonable valuation of our stocks. The PMS is down by0.2percent when compared to fall in Sensex by 5.8 and fall in Nifty by 4.9 percent. Our performance would have been much better but for sharp fall in price of one of our key stock – Coromandel International, a leading Agrisolution providing company, due to underperforming monsoon. Performance Table Looking at the strength of our current portfolio, we expect it to do exceedingly well from here on over next 2-3 years. If the Indian economy has to improve going forward, it should be led by investment cycle and not by the consumption cycle. Consumption in India is a secular growth story and that will continue, but the real acceleration in growth rates should come more from the investments – supported by falling interest rate cycle – and less from the consumption side. Currently, infrastructure, engineering and related interest rate sensitive stocks comprise almost half of our portfolio. Final Thought: We believe, the flux in global markets following Chinese currency devaluation and speculation over the U.S. Fed rate hike as transient features which will not impact India because its “real economy” remains sound and is in a position to post robust growth. Eventually, when these transient things blow over, then it is the real economy that is going to matter. The Indian economy has low global linkages, with largely intrinsic growth. It should benefit from the low energy and commodity prices. However, when an emerging market fund sees redemptions, it could sell all the markets it has positions in. It could choose to sell what it can, and not what it should. In the medium term, these will turn into great opportunities. The problems of fund-flow plumbing should help accelerate India becoming an asset class by itself in coming quarters and years. This could be India’s moment. Interesting times lie ahead. Bharat Sheth September 30, 2015 DISCLAIMER: This communication does not constitute or form part of any offer or recommendation or solicitation to subscribe or to deal with QuestPMS. The views expressed by Ajay Sheth, Portfolio Manager QuestPMS are his personal views as on the date mentioned. These should not be construed as investment advice to anyone. This communication may include statements that may constitute forward looking statements. The statements included herein may include statements of future expectations and, are based on the author’s views, observations and assumptions and involve known and unknown risks and uncertainties that could cause the actual results, performance or events to differ substantially or materially from those expressed or implied in such statements. The author does not undertake to revise the forward looking statements from time to time. No representation, warranty, guarantee or undertaking, express or implied is or will be made. No reliance should be placed on the accuracy, completeness or fairness of the information, estimates, opinions contained in this communication. Before acting on any information contained herein, the readers should make their own assessment of the relevance, accuracy and adequacy of the information and seek appropriate professional advice and, shall be fully responsible for the decisions taken by them. |